It is not uncommon to see people putting off the decision to save and invest for later years—when they earn more money, or when they have spare money after taking care of their commitments, or, when they know what they need the money for.

The earlier you start investing, the better it is, even if it is a small amount. That’s because the power of compounding shows its magic only with time.

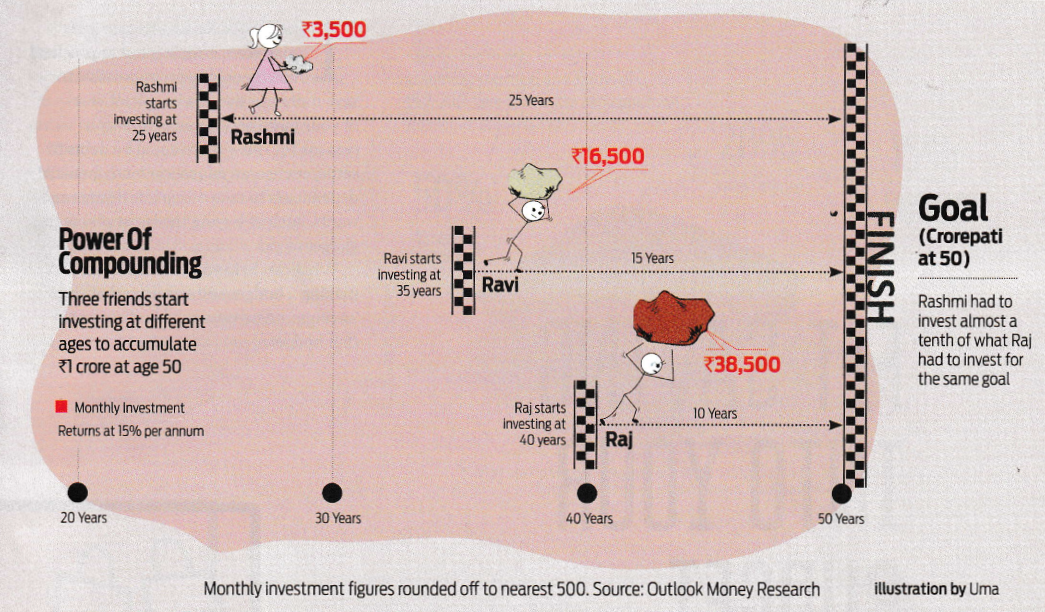

Here’s how compounding works its magic in the real world.

Suppose Rashmi, Ravi and Raj start investing at different ages. Rashmi starts investing when she is 25, Ravi at 35, and Raj at 40. If they are all saving to accumulate ₹1 crore at age 50, Rashmi will invest ₹3,500 for 25 years, Ravi ₹16,500 for 15 years and Raj ₹35,500 for 10 years.

To reach the same goal of ₹1 crore, Rashmi will only need to invest around ₹3,5oo per month, Ravi will have to invest more than five times, and Raj more than 12 times (see Power Of Compounding).

Note that the difference in the total amount invested by the three is also huge.

Over 25 years, Rashmi would have invested around ₹10.5 lakh, Ravi would have put in around ₹30 lakh and Raj would have saved around ₹46 lakh.

In other words, Rashmi invested the least of money to reach the same goal. That’s because she invested for a longer term and the power of compounding worked in her favour.

Hence, if you are interested in using the power of compounding at an early age call us 982018367 or simply fill up the form below…

Source: Outlook Money