In just a few weeks, schools will reopen after the summer break and children’s education is brought back into focus. Parents recognize that higher education plays a vital role in their child’s future success, and are willing to forego some comforts in order to give them the best possible start. However, inadequate planning can ruin these plans and this article focuses on how parents can save and invest for their child’s higher educational pursuits.

In just a few weeks, schools will reopen after the summer break and children’s education is brought back into focus. Parents recognize that higher education plays a vital role in their child’s future success, and are willing to forego some comforts in order to give them the best possible start. However, inadequate planning can ruin these plans and this article focuses on how parents can save and invest for their child’s higher educational pursuits.

Why do you need to start education planning when your child is young?

Recently, there has been an increase in students desiring postgraduate education, specialized courses/programs, and professional studies (e.g. engineering, medical, and MBA) that offer attractive career opportunities for children. Unfortunately, the cost of higher education in India has experienced a sharp spike over recent years – private universities and deemed universities offering MBBS degrees are estimated to have prices ranging from 40-50 lakhs, for example. According to a survey conducted in August 2022 by ET Online, these costs are expected to expand by 10% every year for around 10 years. If the current expenditure of the higher education you plan for your child is 20 lakhs now, it is likely to become greater than 50 lakhs after a decade since assuming 10% inflation.

How to plan for your child’s education?

Defining your goal: You need to estimate how much your child’s higher education will cost, based on inflation. If you need help quantifying your financial goal, consult with a certified financial planner or financial advisor. Cost depends on the career goals of your child, including engineering, medicine, MBA, foreign education, etc.

Have an investment plan: In order to achieve your child’s higher education, you need to create a financial plan that tells you how much money to save and invest every month.

Start early, when your child is young: Starting early gives you sufficient time to accumulate the corpus through the power of compounding over a long period of time.

To ensure your child receives the best education, saving alone is not enough; you have to invest in the correct asset classes so that you can gain the returns needed to meet their goals. Investing in mutual fund schemes with suitable risk / return profiles through Systematic Investment Plans (SIPs) is recommended, as compounding over long horizons can be beneficial. If possible, set up a separate fund solely for your child’s education plans, as this will prevent compromising their aspirations for other objectives. Consulting a financial advisor may be wise if you require help with planning for your children’s future.

Where to invest for your child’s higher education?

If Your child is 10 years or younger?

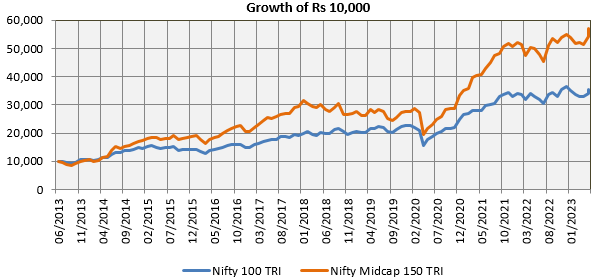

You have 8 or more years to save and invest for your child’s higher education. Investing in midcap and small cap funds may give greater returns, although they are more volatile than large caps (see the chart below). Through Systematic Investment Plans, you can take advantage of price volatility through Rupee Cost Averaging. It’s important to hold a portion in Large / Multicaps too, to ensure diversification and stability. The balance of assets between funds will depend on your risk appetite. As the time for higher education nears, it’s wise to rebalance your asset allocation, to help reduce risk.

If Your child is 11 – 13 years?

You have 5-7 years to save for your child’s higher education, which allows you adequate time for investing. Equity should be the asset class of choice but since your goal is nearer, you can opt for relatively less volatile funds such as large cap and flexicap funds. To boost returns, allocating some midcaps (depending on risk appetite) could also be beneficial. Remember to keep rebalancing your asset allocation as you get closer to the financial goal.

If Your child is 13 years plus?

You’ve now got approximately 5 years or fewer to reach your child’s higher education goals. With a shorter investment tenure, downside risk protection and reliable income become of paramount significance; however, capital appreciation is equally essential. Dynamic Asset Allocation Funds or Balanced Advantage Funds could be the ideal choice for such a situation. These funds manage the asset allocation flexibly in accordance with prevailing market conditions, reducing portfolio downside risks and ensuring stability.

What to do After your child starts higher education?

Once your child embarks on college / university education, Systematic Withdrawal Plan (SWP) is an ideal way to meet tuition fees and other associated costs like boarding (hostel), food, library expenses, books, broadband, mobile phone bills and online courses. SWP allows you to draw a pre-determined sum every month or at any periodic intervals while the remainder of your investment can continue to generate returns. Moreover, if your child is planning to complete a professional degree such as medicine or engineering – which may take 4+ years – or pursue a post graduate program like MBA, M-Tech or MD, investing in equity or equity oriented mutual funds over 5 years plus could deliver higher returns than traditional fixed income investments. Be sure to consider your risk appetite when making decisions and seek guidance from your financial advisor if help is needed with investment planning.